Kiinteistönvälitysalan Keskusliitto

Edustamme toimialaliittona jäsenyhteisöjemme kautta yli 3 500 kiinteistönvälitysalan toimijaa. Autamme alalla toimivia jatkuvasti kehittämään osaamistaan. Toimimme edunvalvojana, sekä asiantuntevan ja luotettavan kiinteistönvälityksen edistäjänä.

Lue lisää

Ajankohtaista

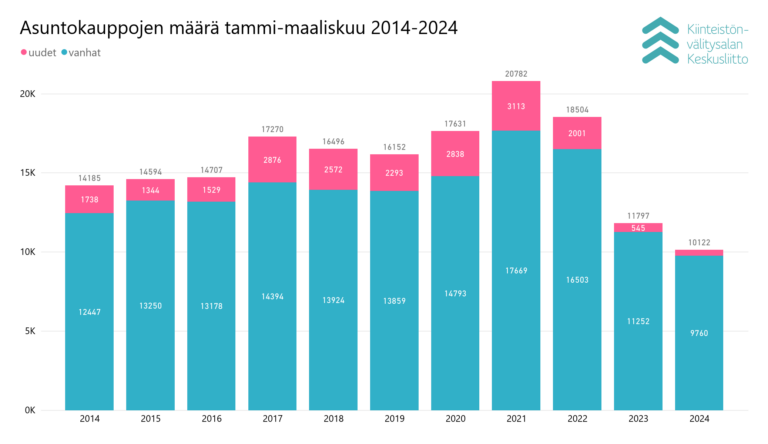

Maaliskuun 2024 asuntomarkkinakatsaus: lakkojen aiheuttama epävarmuus heijastui asuntokauppaan, mutta näkymät kirkastumassa

Maaliskuussa käytettyjen asuntojen kauppa väheni lähes 18 prosenttia viime vuoden maaliskuun kauppamääristä. ”Asuntojen hinnoissa nähtiin suurissa kaupungeissa pientä nousua, mikä saattaa olla ensimmäisiä merkkejä asuntokaupan suhdannekäänteestä”, arvioi Kiinteistönvälitysalan Keskusliiton toimitusjohtaja Tuomas Viljamaa.

Hoitovastikkeiden nousu rasittaa kotitalouksia ja asuntokauppaa

Kiinteistönvälitysalan Keskusliitto selvitti hoitovastikkeiden kehitystä asuntokaupan kohteina olleissa taloyhtiöiden asunnoissa vuosina 2021–2023. Omalla tontilla olevien taloyhtiöiden asuntojen hoitovastikkeet ovat nousseet vuodesta 2021 viime vuoteen verrattuna 7,9 prosenttia ja vuokratontilla olevissa taloyhtiöissä jopa 12,4 prosenttia. Tiedot perustuvat Kiinteistönvälitysalan Keskusliiton Hintaseurantapalvelun asuntokauppadataan.